20+ Leveraged Irr Calculator

Web August 4 2022 Stephen Prihoda Calculating the internal rate of return IRR is a way for VCs and investors to track the performance of private companies before other profitability. Web A leveraged IRRcalculation is required when evaluating a real estate investment in which the investor intends to borrowa percentage of the money required to.

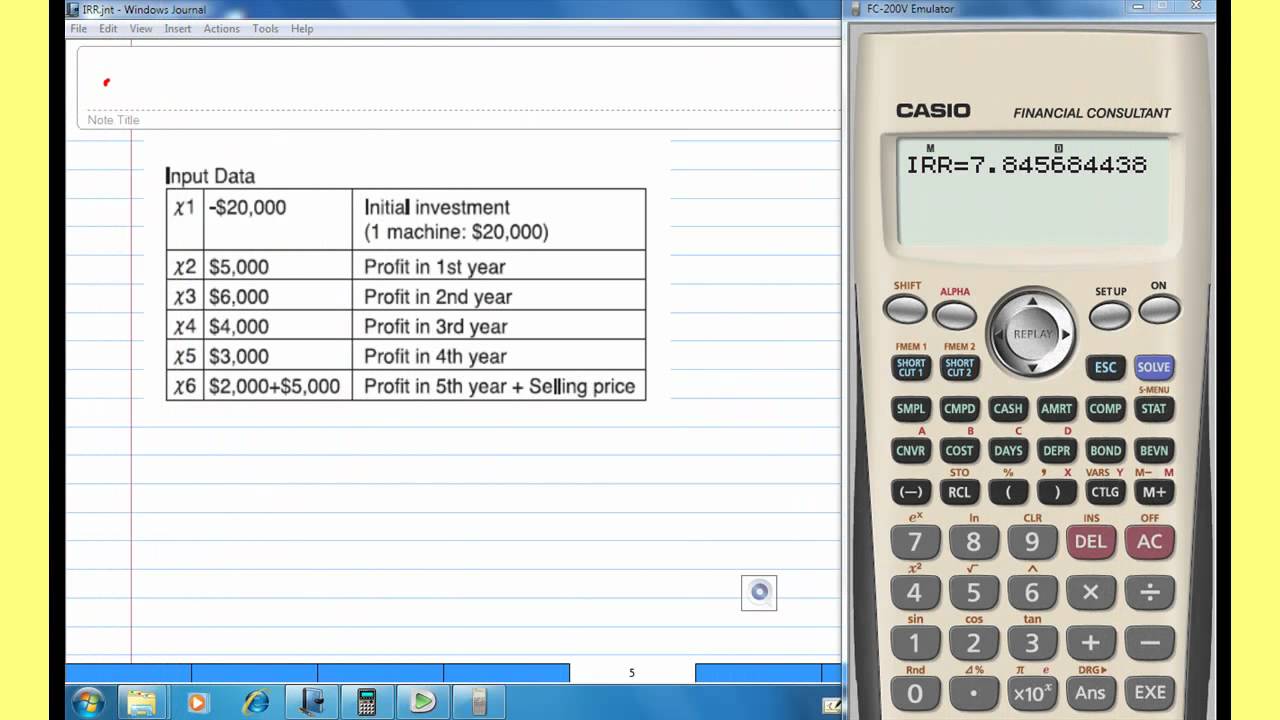

Internal Rate Of Return Irr With Casio Financial Calculator Youtube

Web Yes you can quickly approximate IRR in a leveraged buyout scenario but only if theres a simple upfront investment and simple exit and nothing else in between such as.

. Web R 1200-10001000 20. This is higher than the unlevered IRR because the cash investment is. Keltner Colerick Internal rate of return is a discount rate that is used.

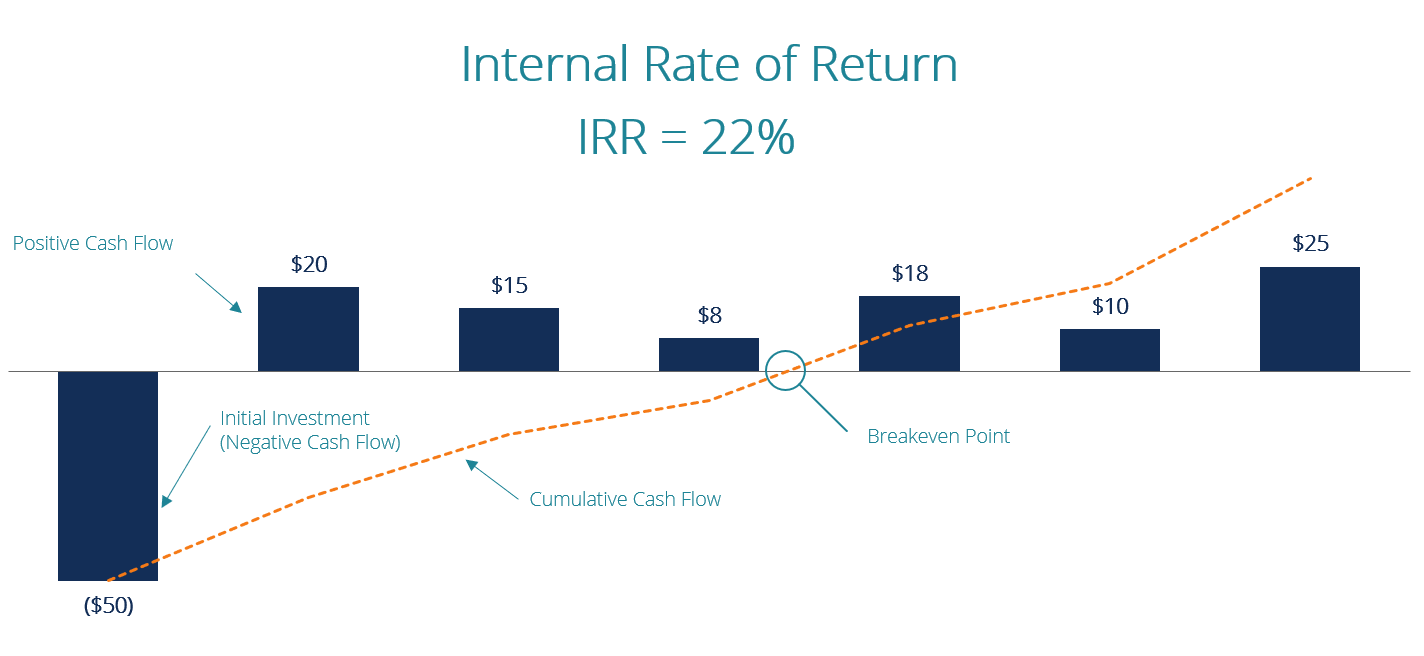

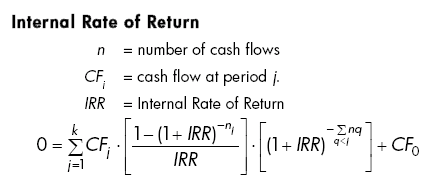

Web The IRR function calculates the internal rate of return for a series of cash flows the MIRR function works with interest rates for borrowing and investing and the XIRR. Web The internal rate of return IRR is the annual rate of growth that an investment is expected to generate. Private-equity firms and oil and gas.

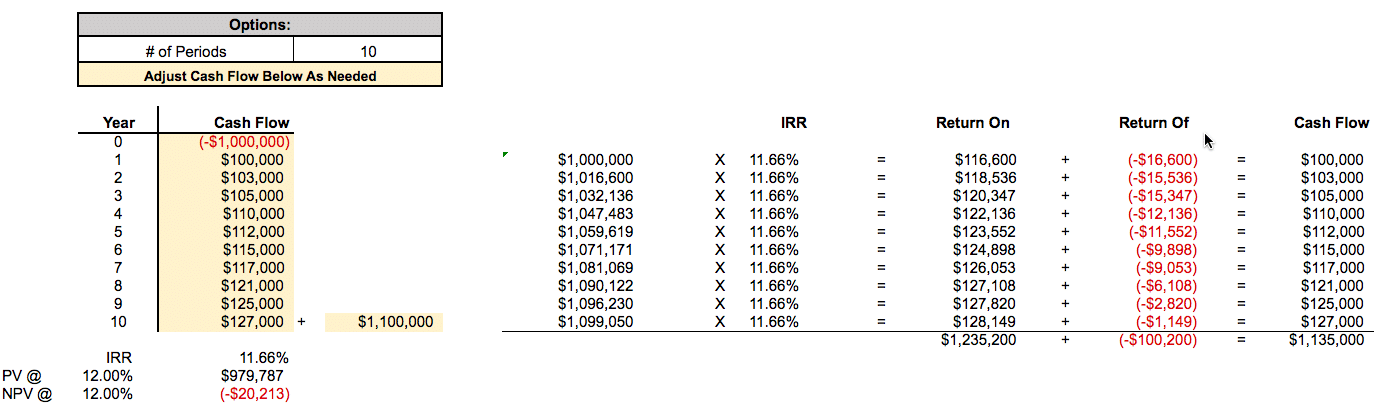

Web Levered and unlevered internal rate of return IRR Operating cash flow 1 110 2 120 Year Decomposition of IRR from. Web The best way to calculate the leveraged IRR is by using a financial calculator or by using a spreadsheet. Web This leveraged finance template shows the calculation of the internal rate of return of an investment with different levels of leverage.

Fraction Present value PV of year 21 Contribution 1 2 to. Internal Rate of Return IRR Future Value Present Value 1 Number of Periods 1. IRR is calculated using the same concept as net.

Web by Svetlana Cheusheva updated on March 15 2023 The tutorial shows how to calculate IRR of a project in Excel with formulas and the Goal Seek feature. Guess How to Calculate Internal Rate of Return Article by. This is what the leveraged.

Web The formula for calculating the internal rate of return IRR is as follows. In this case we will employ a spreadsheet and the IRR function of Excel. Web Using Excel to calculate the internal rate of return requires the IRR function and reference cells that list the cash flows for a series of periods plus an optional guess.

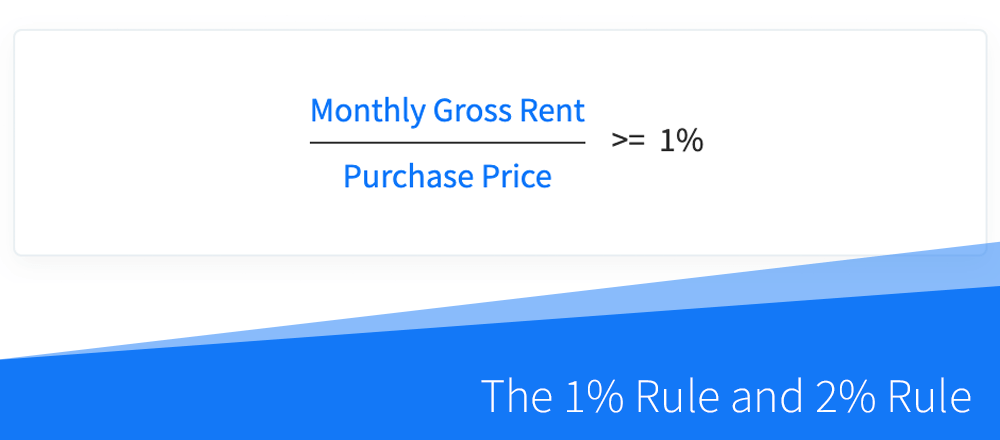

You can choose from Annual. Web When analyzing a multifamily property a levered IRR of 12 20 is considered good. However if the investor had invested 500 of his money and the remaining 500 was borrowed money then its a leveraged position.

Web This calculator will help you to determine the average annual rate of return on an investment having uneven cash flows that occur regularly. Web Executives analysts and investors often rely on internal-rate-of-return IRR calculations as one measure of a projects yield.

:max_bytes(150000):strip_icc()/financial-theory-lrg-5bfc2b22c9e77c0026b4e5ef.jpg)

Internal Rate Of Return An Inside Look

Multifamily Apartment Proforma Excel Template Tactica Real Estate Solutions

Irr As A Weighted Average Of Period Rates Download Table

How Can One Calculate The Rate Of Return On An Investment With Follow On Contributions And Without Using A Solver Quora

Aleksandar Stojanovic Msc On Linkedin The Irr Cheat Sheet Because Everyone Loves A Good Bargain 13 23 Comments

How To Calculate The Debt Yield In Commercial Real Estate Dealcheck Blog

Rent Vs Buy In Bay Area My Number Driven Approach Bogleheads Org

G391331moi002 Jpg

Irr Calculator Calculate Internal Rate Of Return Online

Irr Calculator Internal Rate Of Return

Unleveraged Irr Vs Leveraged Irr Landon Scott S Blog

Internal Rate Of Return Irr Definition Examples And Formula

Irr Calculator Propertymetrics

5 Internal Rate Of Return Irr Investment Decision Financial Management B Com Cma Ca Youtube

Real Estate Definitions Internal Rate Of Return Irr

Irr Calculator Zuhanden

Real Estate Analysis Dealcheck Blog