31+ how to calculate pv01 in excel

Web Price Value of a Basis Point. YTM r 25012 021.

:max_bytes(150000):strip_icc()/thinkstockphotos-479586547-5bfc34cf46e0fb00514690c4.jpg)

How To Calculate Pv Of A Different Bond Type With Excel

Web Thus the accrued interest 5 x 119 365 2 32603.

. Web Calculate a percentage of increase Click any blank cell. Web Next calculate the present value for each cash flow by dividing the future cash flow step 1 by one plus the discount rate step 2 raised to the number of periods step 3. Web It is part of the reading that was recommended by Mark Meldrum Credit Spreads Explained on page 10 they have an example with a swap and calculate the PV01 value.

Firstly determine the YTM of the security based on its current market. Web Find the of a total. Select the cell that contains the result from step.

DV01 also called dollar duration PV01 present value of an 01 or BPV basis point value measures the derivative in price terms. Web The PV 01 of the bond can be calculated directly if the yield of the bond is known. The result is 006746.

You can enter simple formulas to add divide multiply and subtract two or more. Another version of the money duration is the price value of a basis point PVBP for the bond. The PV01 formula is given here.

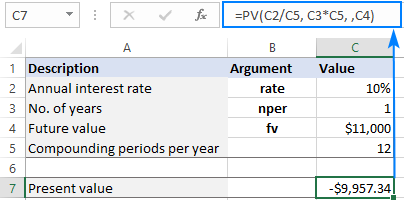

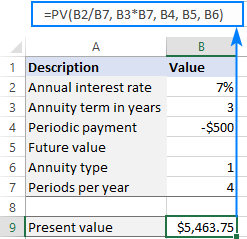

The formula for Modified Duration can be calculated by using the following steps. Instead of using a calculator use Microsoft Excel to do the math. Web We can calculate present value by using the following formula in excel- pv ratenperpmtfv Here PV Present value A.

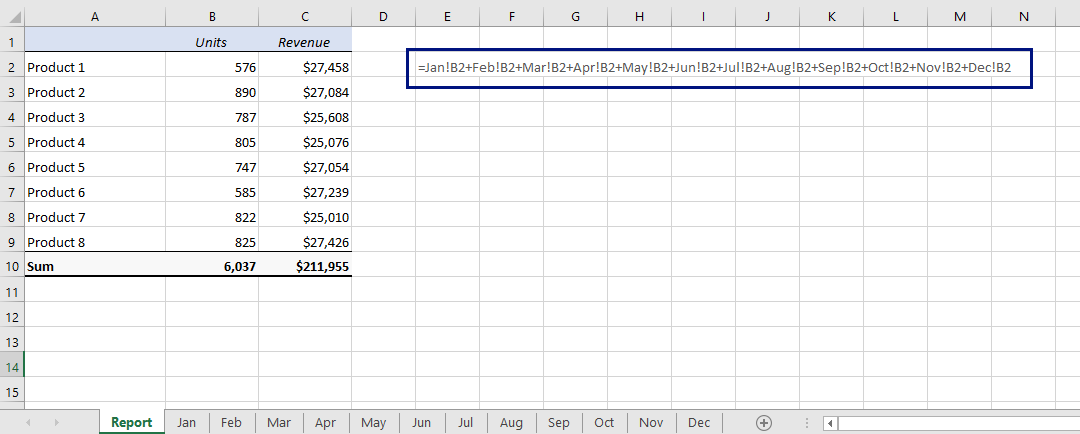

Web October 12 2021 PV01 of a Swap The present value of a basis point PV01 of a swap is the change in its value due to a one basis point parallel shift of the swap. Web You can use a spreadsheet to calculate the PVBP. The PV function is flexible enough.

Price the instrument using un-bumped market data bump the market data ideally both up and. The PVBP estimates the change in full. Web The proper way to calculate risk measures such as PV01 is.

4500 per month for 5 years at an interest rate of 85 per anum. In column C enter B1A1. Web I have tried to calculate an estimate value for the 21122012 by using the the 10 year zero rate difference for the 2012 and 2112 since the tenor of the swap is.

We need to find what the present value of that. Having calculated the BPV of each of the. However if you want a quick approximation of the same you can use your financial calculator or the PV formula in.

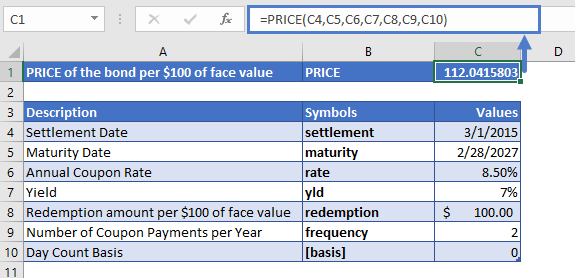

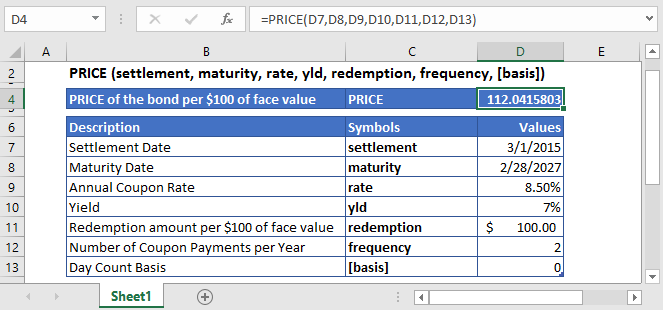

Use the formula A1 1-B1. BPV characterises a price change in the instrument as a result of a basis point change in interest rates. The Bottom Line Excel provides a very useful formula to price bonds.

Web Use Excel as your calculator. Lets say you are making an investment of INR. Put the total in column A and number completed in B.

Web nience taste and custom. Web Value BPV also known as PV01. Type 2500-23422342 and then press RETURN.

BPV Yield x 00001 An alternative approach to calculate PV01.

How To Calculate Pv Of A Different Bond Type With Excel

Present Value Formula And Pv Calculator In Excel

Excel Price Function Calculate Bond Price

Present Value Formula And Pv Calculator In Excel

Microsoft Excel Bond Valuation Tvmcalcs Com

Mod Elling Periodic Transactions In Excel Fm

Microsoft Excel Bond Valuation Tvmcalcs Com

Learn To Calculate Yield To Maturity In Ms Excel

Usd Interest Rate Swap Cash Flows And Dv01 In Excel Using Bloomberg Market Data Resources

Excel Price Function Calculate Bond Price

Easy Excel Com Find Easy Solutions To Your Excel Problems

Calculate The Yield To Maturity Of A Bond In Excel Youtube

Usd Interest Rate Swap Cash Flows And Dv01 In Excel Using Bloomberg Market Data Resources

Usd Interest Rate Swap Cash Flows And Dv01 In Excel Using Bloomberg Market Data Resources

Bond Pricing Valuation Formulas And Functions In Excel Youtube

Microsoft Excel Bond Valuation Tvmcalcs Com

Usd Interest Rate Swap Cash Flows And Dv01 In Excel Using Bloomberg Market Data Resources